How to Calculate the Cost of Living in Vancouver, Washington

Want to know how much it takes to live comfortably in Vancouver, Washington? Look no further! In this article, we will take you through a step-by-step guide on how to calculate the cost of living in this charming city. By the end, you’ll have a clear idea of what your income needs to be to enjoy all that Vancouver has to offer. So, grab a cup of coffee and let’s get started!

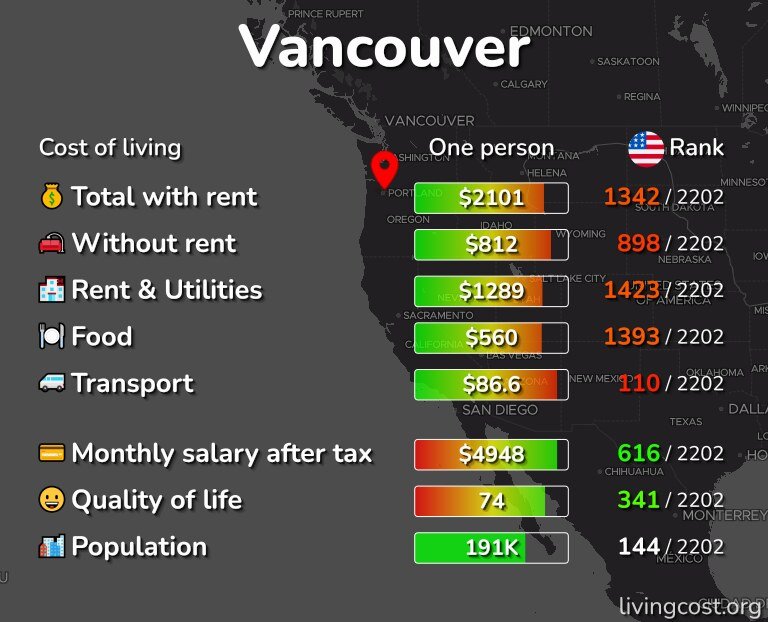

This image is property of livingcost.org.

Table of Contents

ToggleGathering Information

Researching Housing Costs

When determining the cost of living in Vancouver, Washington, one of the most significant expenses to consider is housing costs. To get an idea of the average housing prices in the area, conducting thorough research is crucial. You can start by exploring real estate websites, local rental listings, or contacting a real estate agent. Take note of the different types of housing available, such as apartments, townhouses, or single-family homes, and compare their prices and amenities. Additionally, consider the location’s proximity to amenities and transportation options when assessing the overall value of a property.

Determining Transportation Expenses

Transportation costs can play a substantial role in your overall budget. It’s important to factor in the expenses associated with commuting to work, running errands, and exploring the city. Research the local public transportation options, such as buses or trains, and their associated costs. If you plan on owning a car, consider expenses like gas, maintenance, parking fees, and auto insurance. By understanding your transportation needs and researching the associated costs, you can make an informed decision about how much to allocate for this category.

Calculating Healthcare Costs

Healthcare expenses should not be overlooked when estimating the cost of living in Vancouver, Washington. Start by researching healthcare providers in the area and the average costs of medical services, such as doctor’s visits or prescription medications. If you require health insurance coverage, make sure to include the monthly premiums in your calculations. Consider your own personal healthcare needs and any ongoing medical conditions that may require additional expenses. Being proactive in understanding healthcare costs will ensure that you accurately account for this essential aspect of your budget.

Assessing Food Expenses

Food is a basic necessity, and understanding the costs associated with it is crucial. Begin by estimating your monthly grocery expenses based on your eating habits and dietary preferences. Take the time to explore local grocery stores and compare prices to obtain a better understanding of the average costs in Vancouver, Washington. Additionally, consider your dining-out habits and allocate a budget for eating at restaurants or ordering takeout. By considering both grocery expenses and dining-out budgets, you can better plan for your monthly food costs.

Considering Utility Bills

Utility bills encompass expenses like electricity, water, gas, and internet services. Research the different utility providers in the area and review their pricing structures. Consider the size of the dwelling you plan on living in and its level of energy efficiency. Apartments may have utility costs included in the rent, while homeowners will be responsible for their own utility bills. Keep in mind that different seasons may affect utility costs, so be sure to factor in any potential variations throughout the year. Assessing utility bills is important for understanding the total cost of living in Vancouver, Washington accurately.

Accounting for Taxes and Insurance

Understanding Income Tax Rates

When calculating the cost of living, it’s essential to consider income tax rates. Research the current state income tax rates in Washington and determine how they apply to your income bracket. Understand any deductions or credits that may affect your final tax liability. By comprehending the income tax rates, you can accurately calculate your take-home pay and plan your budget accordingly.

Calculating Property Taxes

If you plan on owning a property in Vancouver, Washington, you’ll need to consider property taxes. Research the average property tax rates in the area and consider how they will factor into your budget. Property taxes are typically based on the assessed value of the property, so it’s important to understand how the local tax authorities determine property values. By accounting for property taxes, you can gauge the true cost of homeownership in Vancouver, Washington.

Budgeting for Health Insurance

Health insurance is a critical consideration for individuals and families. Research the different health insurance options available to you and determine the monthly premiums for each plan. Take into account any deductibles, copayments, or out-of-pocket costs that you may encounter. Health insurance is a significant expense that directly affects your overall cost of living, so allocate a budget for this essential coverage.

Considering Vehicle Insurance

If you plan on owning a vehicle in Vancouver, Washington, be sure to account for vehicle insurance in your budget. Research different insurance providers and compare quotes to understand the average costs. Various factors, such as your driving record, the type of vehicle, and coverage options, can impact the insurance premiums. By factoring in vehicle insurance, you can ensure that you allocate adequate funds for this expense.

Evaluating Education and Childcare Costs

Researching School Tuition Fees

If you have children, it’s important to account for their education costs when calculating the cost of living. Research the schools in the area, both public and private, and determine the tuition fees associated with each. Consider any extracurricular activities or additional expenses that may arise in relation to their education. By understanding the educational landscape and associated costs, you can plan for the educational needs of your children.

Accounting for Preschool and Daycare Expenses

For parents of young children, childcare costs are a significant consideration. Research local daycare centers and preschools to determine the costs associated with these services. Consider the number of days and hours your child will attend, as well as any additional fees for extended care or specialized programs. By accounting for preschool and daycare expenses, you can accurately assess the overall cost of living in Vancouver, Washington.

Considering College or University Costs

If you or your children plan on pursuing higher education, it’s crucial to factor in the costs associated with college or university. Research local post-secondary institutions and their tuition fees. Consider potential additional expenses like textbooks, housing, and transportation. By accounting for these educational costs, you can plan for the future and ensure that you’re financially prepared for higher education.

Factoring in Entertainment and Recreation

Budgeting for Dining Out and Entertainment

The cost of dining out and entertainment can significantly impact your monthly expenses. Research local restaurants, cafes, and entertainment venues to understand the average costs. Consider your own lifestyle and preferences when allocating a budget for dining out and entertainment. This category may include expenses like movie tickets, concert tickets, or social outings with friends. By budgeting for these activities, you can maintain a balanced and enjoyable lifestyle while living in Vancouver, Washington.

Calculating Gym or Fitness Club Memberships

If maintaining an active lifestyle is important to you, it’s essential to include gym or fitness club memberships in your budget. Research the local fitness options and inquire about membership fees and any additional costs. Consider your fitness goals and the amenities you want from a gym or fitness club. By calculating the costs associated with maintaining your fitness routine, you can ensure that you prioritize your well-being while managing your expenses.

Considering Recreational Activities

Recreational activities, such as sports leagues, hobbies, or local attractions, are vital for leisure and personal enjoyment. Research the costs associated with participating in these activities in Vancouver, Washington. Consider any membership fees, equipment costs, or travel expenses that may arise. By factoring in recreational activities, you can maintain a well-rounded lifestyle and ensure that you have room in your budget for personal enjoyment.

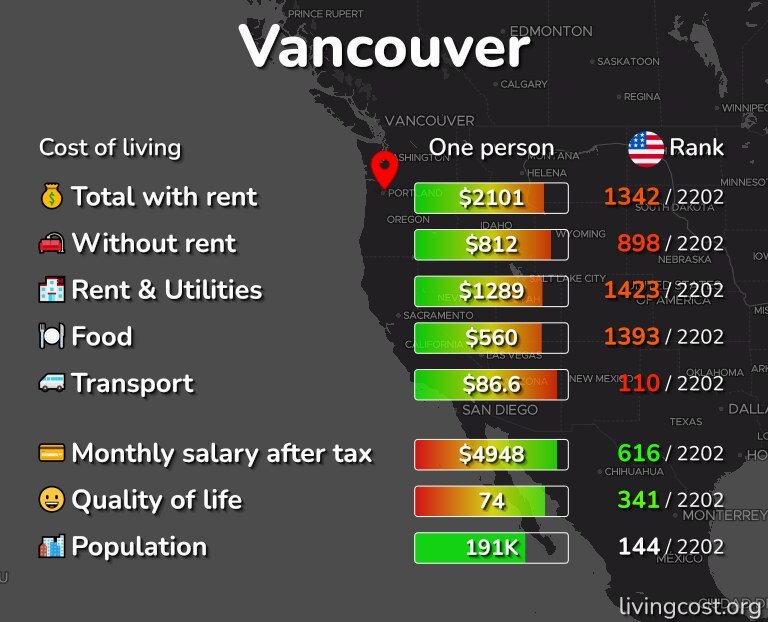

This image is property of livingcost.org.

Including Miscellaneous Expenses

Accounting for Shopping and Personal Care

Shopping and personal care expenses should be included in your budget. Consider your regular shopping needs, such as clothing, personal hygiene products, and household items. Research the local retailers and compare prices to estimate the average costs. Additionally, allocate a budget for personal care services like haircuts, salon visits, or spa treatments. By accounting for shopping and personal care, you can ensure that you’re financially prepared for your routine needs.

Budgeting for Miscellaneous Costs

There are always unforeseen expenses that come up from time to time. Allocate a portion of your budget for miscellaneous costs to account for these unexpected expenses. Such costs may include vehicle repairs, home maintenance, or emergency situations. By including a buffer for miscellaneous expenses, you can be prepared for the unexpected and avoid financial stress.

Considering Savings and Retirement Contributions

While calculating the cost of living, it’s crucial to prioritize savings and retirement contributions. Determine a percentage of your income that you can allocate towards savings and retirement. Research different retirement account options and consider working with a financial advisor to make informed decisions. By prioritizing savings and retirement, you can build a secure financial future while managing your day-to-day expenses.

Comparing Vancouver, Washington with Other Locations

Researching Cost of Living Index

To gain a comprehensive understanding of the cost of living in Vancouver, Washington, it’s beneficial to compare it with other locations. Research the cost of living index and compare it to other cities or regions you’re considering. The cost of living index provides valuable insights into the overall affordability of an area by considering factors such as housing, transportation, healthcare, and more. Evaluating the cost of living index allows you to make informed decisions when considering different locations.

Comparing Housing Prices

One significant factor in comparing locations is housing prices. Research the average housing prices in Vancouver, Washington, and compare them with other areas you’re considering. Look into the housing types and amenities available in each location to accurately evaluate the value for your money. By comparing housing prices, you can determine which location aligns with your budget and lifestyle preferences.

Assessing Transportation Costs

Transportation costs can vary significantly depending on the location. Research the transportation options and costs in Vancouver, Washington, and compare them with other areas. Consider factors like public transportation availability, gas prices, and commuting distances. By comparing transportation costs, you can gauge the impact on your budget and lifestyle when choosing between different locations.

Evaluating Healthcare Expenses

Healthcare expenses can also vary based on location. Research the healthcare options and costs in Vancouver, Washington, and compare them with other areas you’re considering. Consider factors like health insurance costs, healthcare provider availability, and the quality of healthcare services. By evaluating healthcare expenses, you can ensure that your chosen location aligns with your healthcare needs without putting a strain on your budget.

Considering Education and Childcare Costs

If you have children or plan on pursuing higher education, it’s essential to evaluate the education and childcare costs in different locations. Research the school tuition fees, preschool costs, and college expenses in Vancouver, Washington, and compare them with other areas. Consider the quality of education and available amenities when making comparisons. By considering education and childcare costs, you can make an informed decision about which location offers the most value for your educational needs.

Comparing Entertainment and Recreation Expenses

Entertainment and recreation expenses contribute to your overall quality of life. Research the costs of dining out, entertainment activities, and recreational options in Vancouver, Washington, and compare them with other locations. Consider factors like the availability of cultural events, recreational facilities, and local attractions when making comparisons. By comparing entertainment and recreation expenses, you can determine which location offers a lifestyle that aligns with your preferences while remaining within your budget.

This image is property of pdxmovers.com.

Creating a Budget and Calculating the Cost of Living

Summarizing All Expenses

After gathering all the necessary information, it’s time to summarize and organize your expenses. Create a comprehensive list that includes all the categories mentioned earlier, such as housing costs, transportation expenses, healthcare costs, food expenses, utility bills, taxes, insurance, education and childcare costs, entertainment and recreation expenses, and miscellaneous expenses. This summary will provide an overview of all the financial aspects involved in calculating the cost of living in Vancouver, Washington.

Determining Monthly and Annual Costs

Once you have a summary of all your expenses, it’s time to calculate the monthly and annual costs. Start by determining your monthly expenses for each category by adding up the estimated costs. Don’t forget to consider any annual expenses that need to be divided into monthly amounts. Once you have your monthly expenses, multiply them by 12 to calculate your annual costs. This step will give you a clear picture of the total amount you need to budget for and the income required to cover your living expenses in Vancouver, Washington.

In conclusion, calculating the cost of living in Vancouver, Washington involves gathering comprehensive information about various expenses, such as housing costs, transportation expenses, healthcare costs, food expenses, utility bills, taxes, insurance, education and childcare costs, entertainment and recreation expenses, and miscellaneous expenses. By researching and considering all these factors, you can create an accurate budget that reflects the true cost of living in this vibrant city. Taking the time to calculate the cost of living will help you make informed decisions about your finances and ensure that you can comfortably afford your desired lifestyle in Vancouver, Washington.

You May Also Like

Is Vancouver Washington Expensive?

10 January 2024

Exploring a Livable Wage in Washington State

14 January 2024